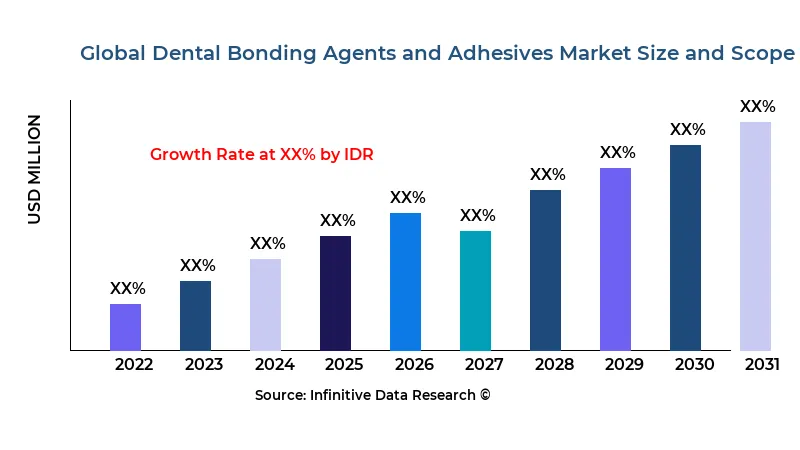

Dental Bonding Agents and Adhesives Market Growth CAGR Overview

According to research by Infinitive Data Research, the global Dental Bonding Agents and Adhesives Market size was valued at USD 3.4 Bln (billion) in 2024 and is Calculated to reach USD 4 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 6.8% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Consumer Goods industries such as Drugs Stores, Supermarket, Online Stores, OtherThe dental bonding agents and adhesives market has undergone considerable evolution, driven by increasing demand for advanced dental restorative procedures. The market dynamics are shaped by technological advancements in dental materials and a growing emphasis on minimally invasive dentistry. Enhanced product formulations that offer superior bonding strength and longevity have redefined clinical practices, leading to a steady expansion of the market. Shifts in consumer awareness regarding dental aesthetics and overall oral health have further reinforced the importance of high-performance adhesives in dental procedures.

Rapid advancements in research and development have introduced novel formulations that cater to a wide array of dental applications. The incorporation of nanotechnology and improved resin compositions has elevated the overall quality of dental bonding agents. These improvements have contributed to a more competitive market landscape where both established players and emerging companies strive to deliver innovative solutions. Additionally, collaborations between dental research institutes and commercial manufacturers have accelerated the pace of product innovation, thereby increasing market dynamism. This environment has fostered a competitive spirit where continuous improvement is not just desired but expected by practitioners.

The market is also influenced by evolving regulatory frameworks that govern the safety and efficacy of dental materials. Stringent quality standards have driven manufacturers to invest in advanced testing protocols and enhanced production processes. These regulatory requirements have, in turn, increased consumer confidence in dental products, prompting dental professionals to adopt newer and more effective bonding agents. As regulatory landscapes become more harmonized globally, companies are finding it easier to enter new markets, thus stimulating further growth. The convergence of these factors has resulted in a robust market with a clear trajectory of consistent advancement.

Economic factors and healthcare expenditure trends play a critical role in shaping market dynamics. Increased investments in dental healthcare infrastructure and a rise in disposable incomes have led to greater demand for advanced dental procedures. Dental clinics and hospitals are expanding their service portfolios to include cosmetic and restorative treatments, which has significantly boosted the adoption of high-quality bonding agents. Additionally, the shift towards preventive dentistry and early intervention has spurred innovation and increased product demand. As a result, the competitive landscape is characterized by both technological advancements and an evolving economic environment, ensuring sustained market momentum.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Dental Bonding Agents And Adhesives Market Growth Factors

One of the primary drivers of growth in the dental bonding agents and adhesives market is the continuous innovation in material science. Manufacturers are investing significantly in research and development to formulate adhesives that offer improved bond strength and longer durability. These advancements not only enhance clinical outcomes but also reduce the incidence of post-procedural complications. Increased awareness among dental professionals regarding the benefits of the latest bonding technologies has fueled market expansion. As these products become more refined, their adoption across various dental procedures continues to rise, driving overall market growth.

The growing demand for cosmetic dentistry and restorative dental procedures is another key factor contributing to market expansion. Rising consumer expectations regarding dental aesthetics have led to an increase in elective procedures that require state-of-the-art bonding agents. Dental practices are increasingly incorporating modern adhesive systems into their treatment protocols to achieve better aesthetic and functional results. This trend has not only boosted product demand but also stimulated innovation among manufacturers who strive to offer superior solutions. The market is witnessing a paradigm shift where the integration of advanced adhesives is becoming a standard of care, thereby reinforcing market growth. The interplay between consumer demand and technological innovation continues to propel this segment forward.

Increased dental tourism and heightened global connectivity have further spurred market growth. Patients from various parts of the world are seeking high-quality dental treatments, driving demand for advanced bonding agents in international markets. As dental clinics upgrade their equipment and procedures to meet global standards, the adoption of premium adhesives becomes inevitable. This cross-border influence has led to the standardization of product quality and improved access to advanced dental solutions worldwide. With the integration of global best practices, manufacturers are increasingly focusing on product excellence and broader market reach. The positive impact of dental tourism on market growth cannot be understated, as it creates opportunities for expanding the customer base across continents.

Enhanced access to modern dental healthcare in emerging economies also acts as a strong growth catalyst. As disposable incomes rise and healthcare infrastructure improves, more patients are opting for advanced dental treatments that require high-quality bonding agents. Dental clinics in these regions are rapidly modernizing, adopting advanced procedures to meet growing patient expectations. Manufacturers are seizing this opportunity by tailoring their product offerings to suit local market needs, further driving market expansion. The confluence of improved healthcare access, rising patient awareness, and increased professional training has created an environment conducive to market growth. As a result, the market is poised for sustained development, fueled by innovation and expanding global demand.

Market Analysis By Competitors

- 3M

- Honeywell

- SPRO Medical

- KOWA

- Makrite

- Owens & Minor

- Uvex

- Kimberly-clark

- McKesson

- Prestige Ameritech

- CM

- Molnlycke Health

- Moldex-Metric

- Ansell

- Unicharm

- Cardinal Health

- Te Yin

- Japan Vilene

- Shanghai Dasheng

- Hakugen

- Essity (BSN Medical)

- Zhende

- Winner

- Jiangyin Chang-hung

- Tamagawa Eizai

- Gerson

- Suzhou Sanical

- Sinotextiles

- Alpha Pro Tech

- Irema

- Yuanqin

- Troge Medical

By Product Type

- Disposable Masks

- Reusable Masks

By Application

- Drugs Stores

- Supermarket

- Online Stores

- Other

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Dental Bonding Agents And Adhesives Market Segment Analysis

Distribution ChannelThe distribution channel for dental bonding agents and adhesives is evolving to meet the sophisticated demands of modern dental practices. Traditionally reliant on direct sales and dental supply distributors, the market is now witnessing a significant shift towards online platforms and digital ordering systems. Manufacturers have increasingly adopted integrated supply chain solutions to ensure that products reach dental clinics and hospitals efficiently. This shift has allowed for real-time inventory management and rapid delivery schedules, which are critical in high-demand clinical settings. Enhanced distribution channels also facilitate broader geographic reach and improved customer engagement. As digital transformation continues to impact the healthcare industry, traditional distributors are reinventing their models to incorporate e-commerce strategies. This convergence of offline and online channels ensures that dental professionals have timely access to the latest products. The dynamic distribution landscape ultimately supports a more responsive and agile market environment.

CompatibilityCompatibility in the context of dental bonding agents and adhesives refers to the products’ ability to work seamlessly with various dental substrates and restorative materials. Manufacturers focus on formulating adhesives that are chemically and mechanically compatible with a wide range of dental composites, ceramics, and metals. This compatibility is crucial for ensuring durable bonds and optimal restoration outcomes. The development of versatile adhesive systems has enabled dental practitioners to achieve consistent performance across diverse clinical scenarios. Continuous innovation in formulation technology has resulted in products that not only adhere well but also offer ease of use and reduced sensitivity. The emphasis on compatibility has led to extensive in-vitro and clinical testing protocols that validate product performance. As a result, dental professionals increasingly rely on adhesives that offer both reliability and versatility. Overall, compatibility remains a critical factor in product development and market acceptance.

PricePrice segmentation in the dental bonding agents and adhesives market is driven by the dual objectives of affordability and premium performance. The market accommodates a broad spectrum of products, ranging from cost-effective options for routine procedures to high-end solutions designed for complex restorations. Manufacturers strategically price their products to address the needs of both high-volume dental practices and specialized clinics. Competitive pricing is balanced with a commitment to quality, ensuring that even the more economical options meet stringent clinical standards. The pricing strategy also reflects the level of technological innovation and the value proposition offered by advanced formulations. In many cases, product price is linked to the perceived benefit in terms of durability, ease of application, and patient outcomes. As a result, price differentiation is a key driver of market segmentation and competitive positioning. The interplay between cost, performance, and market demand continues to shape pricing strategies in this segment.

Product TypeProduct type segmentation within the dental bonding agents and adhesives market is marked by a range of formulations designed to cater to different clinical requirements. The market includes products specifically engineered for enamel bonding, dentin adhesion, and multi-mode applications. Each product type is characterized by its unique formulation and performance characteristics, which are tailored to address specific dental restoration challenges. Manufacturers invest in developing specialized adhesives that offer enhanced bond strength, reduced postoperative sensitivity, and improved longevity. The diversity of product types allows dental professionals to select adhesives that best match the restorative procedure at hand, thereby improving clinical outcomes. Product innovation in this segment has led to the creation of formulations that integrate advanced polymerization technologies and improved resin compositions. This wide variety of products supports a nuanced approach to dental restoration, enabling practitioners to customize treatment plans based on patient needs. Overall, the product type segmentation is fundamental to meeting the varied demands of modern dentistry.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

3M, Honeywell, SPRO Medical, KOWA, Makrite, Owens & Minor, Uvex, Kimberly-clark, McKesson, Prestige Ameritech, CM, Molnlycke Health, Moldex-Metric, Ansell, Unicharm, Cardinal Health, Te Yin, Japan Vilene, Shanghai Dasheng, Hakugen, Essity (BSN Medical), Zhende, Winner, Jiangyin Chang-hung, Tamagawa Eizai, Gerson, Suzhou Sanical, Sinotextiles, Alpha Pro Tech, Irema, Yuanqin, Troge Medical |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Dental Bonding Agents And Adhesives Market Regional Analysis

North America is one of the most mature markets for dental bonding agents and adhesives, driven by advanced healthcare infrastructure and a high adoption rate of modern dental technologies. The region is characterized by a strong presence of leading dental manufacturers and a robust network of dental professionals who actively seek out innovative products. With a focus on cosmetic and restorative dentistry, North American dental practices are consistently at the forefront of adopting new adhesive technologies. The market’s stability is further supported by favorable reimbursement policies and continuous investment in dental research and education, making it a critical region for market growth.

Europe exhibits steady growth in the dental bonding agents and adhesives market, owing to its high regulatory standards and a well-established dental care system. European dental practitioners are known for their adherence to best practices and rigorous clinical protocols, which has led to increased demand for premium bonding agents. The region’s market dynamics are further enhanced by collaborative research efforts between universities and industry players, resulting in rapid product innovations. Distribution channels in Europe are highly efficient, ensuring that even the latest formulations quickly reach dental clinics and hospitals. This strong regional foundation, combined with an emphasis on quality and precision, has created a thriving market environment. As patient expectations continue to evolve, European manufacturers are continuously refining their products to meet both functional and aesthetic requirements. Overall, Europe remains a key growth driver for the segment.

In the Asia-Pacific region, the dental bonding agents and adhesives market is emerging rapidly, supported by improvements in healthcare infrastructure and rising disposable incomes. Countries within this region are increasingly investing in modern dental clinics and advanced restorative procedures, thereby boosting demand for high-performance adhesives. The market is characterized by a mix of local manufacturers and international brands competing for market share. Increased exposure to global dental trends and rapid digital transformation in healthcare distribution have further accelerated market growth. As the region’s middle class expands and consumer expectations shift towards quality healthcare, the demand for sophisticated dental adhesives is expected to rise. Regulatory reforms and government initiatives aimed at enhancing oral healthcare access further stimulate this growth. The region’s dynamic environment presents significant opportunities for both innovation and expansion in the dental materials market.

Latin America and the Middle East are gradually emerging as promising markets for dental bonding agents and adhesives. Although these regions have historically lagged behind in terms of technological adoption, recent improvements in dental care infrastructure have started to shift market trends. Increased investments in private dental practices and government-backed healthcare initiatives have paved the way for better access to advanced dental materials. As a result, practitioners in these regions are becoming more receptive to modern bonding agents that offer improved clinical outcomes. The growth in these areas is further supported by rising consumer awareness and demand for quality dental care. With continued economic development and strategic industry investments, these regions are poised to witness significant market expansion. The gradual convergence with global dental standards is set to further bolster the market in Latin America and the Middle East.

global Dental Bonding Agents and Adhesives market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| 3M | XX | XX | XX | XX | XX | XX |

| Honeywell | XX | XX | XX | XX | XX | XX |

| SPRO Medical | XX | XX | XX | XX | XX | XX |

| KOWA | XX | XX | XX | XX | XX | XX |

| Makrite | XX | XX | XX | XX | XX | XX |

| Owens & Minor | XX | XX | XX | XX | XX | XX |

| Uvex | XX | XX | XX | XX | XX | XX |

| Kimberly-clark | XX | XX | XX | XX | XX | XX |

| McKesson | XX | XX | XX | XX | XX | XX |

| Prestige Ameritech | XX | XX | XX | XX | XX | XX |

| CM | XX | XX | XX | XX | XX | XX |

| Molnlycke Health | XX | XX | XX | XX | XX | XX |

| Moldex-Metric | XX | XX | XX | XX | XX | XX |

| Ansell | XX | XX | XX | XX | XX | XX |

| Unicharm | XX | XX | XX | XX | XX | XX |

| Cardinal Health | XX | XX | XX | XX | XX | XX |

| Te Yin | XX | XX | XX | XX | XX | XX |

| Japan Vilene | XX | XX | XX | XX | XX | XX |

| Shanghai Dasheng | XX | XX | XX | XX | XX | XX |

| Hakugen | XX | XX | XX | XX | XX | XX |

| Essity (BSN Medical) | XX | XX | XX | XX | XX | XX |

| Zhende | XX | XX | XX | XX | XX | XX |

| Winner | XX | XX | XX | XX | XX | XX |

| Jiangyin Chang-hung | XX | XX | XX | XX | XX | XX |

| Tamagawa Eizai | XX | XX | XX | XX | XX | XX |

| Gerson | XX | XX | XX | XX | XX | XX |

| Suzhou Sanical | XX | XX | XX | XX | XX | XX |

| Sinotextiles | XX | XX | XX | XX | XX | XX |

| Alpha Pro Tech | XX | XX | XX | XX | XX | XX |

| Irema | XX | XX | XX | XX | XX | XX |

| Yuanqin | XX | XX | XX | XX | XX | XX |

| Troge Medical | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Dental Bonding Agents and Adhesives market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Disposable Masks

XX

XX

XX

XX

XX

Reusable Masks

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Disposable Masks | XX | XX | XX | XX | XX |

| Reusable Masks | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Dental Bonding Agents and Adhesives market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Drugs Stores

XX

XX

XX

XX

XX

Supermarket

XX

XX

XX

XX

XX

Online Stores

XX

XX

XX

XX

XX

Other

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Drugs Stores | XX | XX | XX | XX | XX |

| Supermarket | XX | XX | XX | XX | XX |

| Online Stores | XX | XX | XX | XX | XX |

| Other | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Dental Bonding Agents And Adhesives Market Competitive Insights

The competitive landscape for dental bonding agents and adhesives is marked by a blend of longstanding industry stalwarts and agile newcomers. Companies in this sector are continually investing in research and development to improve product performance and expand their portfolio. These firms compete on several fronts including innovation, product quality, and regulatory compliance, ensuring that only the most advanced adhesives gain market traction. Strategic alliances with dental research institutions and clinical partners are common, as companies strive to validate their product claims and gain market credibility.

Technological innovation is a central pillar in the competitive strategy of leading companies. With continuous advancements in polymer science and adhesive formulations, firms are able to offer products that significantly enhance treatment outcomes. This innovation-driven competition has led to a rapid turnover of product generations, with each new launch aimed at addressing specific clinical challenges. Companies that effectively integrate cutting-edge technologies into their adhesive systems are well positioned to capture larger market shares. The race to achieve superior bonding strength and durability remains a critical determinant of success. As a result, firms are heavily focused on optimizing their R&D investments and fostering a culture of continuous improvement. The competitive dynamics are characterized by both incremental improvements and disruptive innovations that redefine industry standards.

Price competition and cost management also play vital roles in shaping the market environment. Companies are under constant pressure to balance cost efficiencies with the need to maintain high quality and performance standards. This is particularly important in markets where healthcare expenditure is closely scrutinized and dental practices seek cost-effective yet reliable solutions. Firms that can optimize their manufacturing processes and reduce production costs without compromising on product efficacy tend to gain a competitive advantage. As market participants refine their cost structures, price becomes a strategic lever that influences market share. The delicate balance between affordability and premium performance continues to drive competitive strategies in this segment. In this context, competitive pricing coupled with innovation remains key to maintaining and growing market presence.

Digital transformation and enhanced distribution strategies have further intensified market competition. Companies are leveraging online platforms, digital marketing, and advanced customer relationship management systems to reach a wider audience and create brand loyalty. This integrated approach allows them to rapidly respond to market trends and customer feedback, ultimately driving higher satisfaction and repeat business. As digital channels become increasingly important, companies that successfully blend traditional sales strategies with modern digital tools are emerging as market leaders. The ability to effectively manage both online and offline distribution networks is proving to be a critical competitive differentiator. Ultimately, the integration of digital strategies with core business processes is redefining competitive dynamics in the dental adhesives market.

Dental Bonding Agents And Adhesives Market Competitors

USA:

• DentalBond Inc.

• AdhesivePro USA

• BondTech Solutions

• SmileSecure

• DentaBond Corp.

Germany:

• ZahnKitt AG

• BondMaster GmbH

• DentalAdhesive GmbH

• SmileBond Deutschland

• KittPro

Japan:

• BondTech Japan

• DentalSecure JP

• SmileBond Nippon

• AdhesivePlus

• Kirei Bond

China:

• DentalBond China

• AdhesiveMaster CN

• BondPlus China

• SmileSecure China

• KittChina

UK:

• UK DentalBond

• AdhesiveSafe UK

• BondPro

• SmileAdhesive UK

• SecureBond UK

France:

• DentalAdhesive France

• BondingMaster

• SmileSecure France

• AdhesivePlus France

• KittFrance

Dental Bonding Agents And Adhesives Market Top Competitors

DentalBond Inc.

DentalBond Inc. is a trailblazer in the dental bonding market with an unwavering commitment to innovation and quality. The company has developed advanced adhesive formulations that deliver superior clinical performance. It has established a robust presence across multiple regions, driven by strategic partnerships with dental clinics and distributors. DentalBond Inc. continuously invests in research and development to maintain its competitive edge. Its products are widely recognized for reliability and ease of use in diverse clinical applications. The firm consistently meets stringent regulatory standards, ensuring high patient safety. Its market leadership is underpinned by a strong portfolio of patented technologies. DentalBond Inc. remains a dominant force in shaping industry trends and clinical practices.

AdhesivePro USA

AdhesivePro USA is a well-established leader in the dental bonding agents segment, known for its commitment to cutting-edge technology. The company has built a reputation for delivering high-performance adhesives that are trusted by dental professionals nationwide. Its innovative product range caters to various clinical needs, from routine procedures to complex restorations. AdhesivePro USA leverages advanced manufacturing techniques to ensure consistent product quality. Its strategic market initiatives have resulted in a strong distribution network and significant market penetration. The company’s focus on customer feedback drives continuous product improvement. Regulatory compliance and safety are central to its business ethos. AdhesivePro USA continues to set high standards in the industry with its forward-thinking approach.

BondTech Solutions

BondTech Solutions has carved a niche as an innovator in the dental bonding and adhesives market, offering state-of-the-art solutions for dental restorations. The company prides itself on its advanced adhesive formulations that are both versatile and reliable. It has a solid presence in the market, driven by strong relationships with dental professionals and educational institutions. BondTech Solutions’ commitment to R&D has resulted in several industry-first innovations. Its products are known for their excellent bonding strength and long-term durability. The company continuously refines its technology to meet evolving clinical needs. Its robust quality control measures ensure high standards across all product lines. BondTech Solutions is widely recognized as a key player driving innovation in dental adhesives.

SmileSecure

SmileSecure is renowned for its high-quality dental bonding agents that have become a staple in modern dental practices. The company has successfully integrated innovative technology with user-friendly product designs. Its adhesives are celebrated for delivering consistent and reliable clinical outcomes. SmileSecure’s market strategy focuses on extensive R&D and strategic alliances with dental practitioners. The company has earned strong brand loyalty through continuous product improvements. Its comprehensive distribution network ensures timely delivery and widespread market presence. Regulatory compliance and clinical efficacy are core to its operations. SmileSecure remains a trusted name in the competitive dental bonding market.

DentaBond Corp.

DentaBond Corp. is a formidable competitor in the dental bonding market, recognized for its innovative and reliable adhesive solutions. The company has established a reputation for excellence through continuous product innovation and quality enhancement. It boasts a strong market presence driven by a comprehensive product portfolio tailored to various dental procedures. DentaBond Corp. invests heavily in research and development to remain at the forefront of technological advancements. Its products consistently meet rigorous clinical and regulatory standards. The firm’s extensive distribution network supports its growing market share. Customer satisfaction and long-term performance are key pillars of its business model. DentaBond Corp. is widely regarded as an industry leader with a forward-thinking approach.

ZahnKitt AG

ZahnKitt AG stands as a prominent European leader in the dental bonding agents and adhesives market. The company is known for its precise formulations that deliver exceptional bonding strength and durability. It maintains a strong presence across multiple markets through strategic partnerships and robust distribution channels. ZahnKitt AG places significant emphasis on research and continuous product development. Its advanced adhesive systems have become a benchmark in clinical applications. The firm upholds strict quality and regulatory standards, ensuring high patient safety. Its innovative approach and market responsiveness have earned it widespread acclaim. ZahnKitt AG remains at the forefront of industry innovation and clinical excellence.

BondMaster GmbH

BondMaster GmbH is a key player in the European dental adhesives market, celebrated for its commitment to innovation and product quality. The company has developed a diverse portfolio of adhesive solutions that cater to various dental restoration needs. Its advanced production processes ensure that all products meet high-quality and regulatory benchmarks. BondMaster GmbH has successfully established long-term relationships with dental clinics and distributors. Continuous investment in research and development has driven its competitive advantage. Its products are known for their superior performance and ease of application. The company’s market strategy emphasizes customer feedback and rapid product iteration. BondMaster GmbH continues to influence market trends with its innovative offerings.

BondTech Japan

BondTech Japan is a leading innovator in the dental bonding market within the Asia-Pacific region. The company’s products are known for their precision engineering and reliable performance in various dental applications. It has built a strong reputation by continuously integrating advanced technologies into its adhesive systems. BondTech Japan’s strategic focus on research and customer collaboration has driven significant product improvements. Its strong market presence is supported by extensive distribution channels and strategic partnerships. The company is dedicated to upholding the highest clinical and regulatory standards. Its commitment to innovation has positioned it as a trusted name among dental professionals. BondTech Japan remains a key driver of technological progress in the industry.

DentalBond China

DentalBond China has rapidly emerged as a competitive force in the dental adhesives market, combining cost efficiency with advanced technological formulations. The company has developed a reputation for offering products that meet international clinical standards. Its expansive distribution network covers both domestic and international markets effectively. DentalBond China places a strong emphasis on continuous innovation and research to enhance product performance. Its competitive pricing strategy coupled with high product quality has led to strong market penetration. The firm actively collaborates with dental institutions to refine its adhesive solutions. Regulatory compliance and consistent quality control are central to its operations. DentalBond China is recognized as a rising star in the global dental bonding market.

UK DentalBond

UK DentalBond is a prominent name in the European dental bonding market, known for its reliable and innovative adhesive solutions. The company has built a strong reputation through its focus on quality, performance, and customer service. Its product portfolio is designed to meet the diverse needs of modern dental practices, ensuring excellent clinical outcomes. UK DentalBond has developed robust distribution channels that span across Europe and beyond. Its commitment to research and development is reflected in the continual evolution of its adhesive formulations. The company places a strong emphasis on regulatory compliance and clinical validation. Its strategic marketing initiatives have solidified its market position among dental professionals. UK DentalBond continues to be a trusted and influential player in the industry.

The report provides a detailed analysis of the Dental Bonding Agents and Adhesives market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Dental Bonding Agents and Adhesives market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Dental Bonding Agents and Adhesives market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Dental Bonding Agents and Adhesives market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Dental Bonding Agents and Adhesives market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Dental Bonding Agents and Adhesives Market Analysis and Projection, By Companies

- Segment Overview

- 3M

- Honeywell

- SPRO Medical

- KOWA

- Makrite

- Owens & Minor

- Uvex

- Kimberly-clark

- McKesson

- Prestige Ameritech

- CM

- Molnlycke Health

- Moldex-Metric

- Ansell

- Unicharm

- Cardinal Health

- Te Yin

- Japan Vilene

- Shanghai Dasheng

- Hakugen

- Essity (BSN Medical)

- Zhende

- Winner

- Jiangyin Chang-hung

- Tamagawa Eizai

- Gerson

- Suzhou Sanical

- Sinotextiles

- Alpha Pro Tech

- Irema

- Yuanqin

- Troge Medical

- Global Dental Bonding Agents and Adhesives Market Analysis and Projection, By Type

- Segment Overview

- Disposable Masks

- Reusable Masks

- Global Dental Bonding Agents and Adhesives Market Analysis and Projection, By Application

- Segment Overview

- Drugs Stores

- Supermarket

- Online Stores

- Other

- Global Dental Bonding Agents and Adhesives Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Dental Bonding Agents and Adhesives Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Dental Bonding Agents and Adhesives Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- 3M

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Honeywell

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- SPRO Medical

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- KOWA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Makrite

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Owens & Minor

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Uvex

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Kimberly-clark

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- McKesson

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Prestige Ameritech

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- CM

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Molnlycke Health

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Moldex-Metric

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Ansell

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Unicharm

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Cardinal Health

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Te Yin

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Japan Vilene

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Shanghai Dasheng

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Hakugen

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Essity (BSN Medical)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Zhende

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Winner

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Jiangyin Chang-hung

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Tamagawa Eizai

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Gerson

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Suzhou Sanical

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sinotextiles

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Alpha Pro Tech

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Irema

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Yuanqin

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Troge Medical

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Dental Bonding Agents and Adhesives Market: Impact Analysis

- Restraints of Global Dental Bonding Agents and Adhesives Market: Impact Analysis

- Global Dental Bonding Agents and Adhesives Market, By Technology, 2023-2032(USD Billion)

- global Disposable Masks, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- global Reusable Masks, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- global Drugs Stores, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- global Supermarket, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- global Online Stores, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- global Other, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Dental Bonding Agents and Adhesives Market Segmentation

- Dental Bonding Agents and Adhesives Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Dental Bonding Agents and Adhesives Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Dental Bonding Agents and Adhesives Market

- Dental Bonding Agents and Adhesives Market Segmentation, By Technology

- Dental Bonding Agents and Adhesives Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Dental Bonding Agents and Adhesives Market, By Technology, 2023-2032(USD Billion)

- global Disposable Masks, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- global Reusable Masks, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- global Drugs Stores, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- global Supermarket, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- global Online Stores, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- global Other, Dental Bonding Agents and Adhesives Market, By Region, 2023-2032(USD Billion)

- 3M: Net Sales, 2023-2033 ($ Billion)

- 3M: Revenue Share, By Segment, 2023 (%)

- 3M: Revenue Share, By Region, 2023 (%)

- Honeywell: Net Sales, 2023-2033 ($ Billion)

- Honeywell: Revenue Share, By Segment, 2023 (%)

- Honeywell: Revenue Share, By Region, 2023 (%)

- SPRO Medical: Net Sales, 2023-2033 ($ Billion)

- SPRO Medical: Revenue Share, By Segment, 2023 (%)

- SPRO Medical: Revenue Share, By Region, 2023 (%)

- KOWA: Net Sales, 2023-2033 ($ Billion)

- KOWA: Revenue Share, By Segment, 2023 (%)

- KOWA: Revenue Share, By Region, 2023 (%)

- Makrite: Net Sales, 2023-2033 ($ Billion)

- Makrite: Revenue Share, By Segment, 2023 (%)

- Makrite: Revenue Share, By Region, 2023 (%)

- Owens & Minor: Net Sales, 2023-2033 ($ Billion)

- Owens & Minor: Revenue Share, By Segment, 2023 (%)

- Owens & Minor: Revenue Share, By Region, 2023 (%)

- Uvex: Net Sales, 2023-2033 ($ Billion)

- Uvex: Revenue Share, By Segment, 2023 (%)

- Uvex: Revenue Share, By Region, 2023 (%)

- Kimberly-clark: Net Sales, 2023-2033 ($ Billion)

- Kimberly-clark: Revenue Share, By Segment, 2023 (%)

- Kimberly-clark: Revenue Share, By Region, 2023 (%)

- McKesson: Net Sales, 2023-2033 ($ Billion)

- McKesson: Revenue Share, By Segment, 2023 (%)

- McKesson: Revenue Share, By Region, 2023 (%)

- Prestige Ameritech: Net Sales, 2023-2033 ($ Billion)

- Prestige Ameritech: Revenue Share, By Segment, 2023 (%)

- Prestige Ameritech: Revenue Share, By Region, 2023 (%)

- CM: Net Sales, 2023-2033 ($ Billion)

- CM: Revenue Share, By Segment, 2023 (%)

- CM: Revenue Share, By Region, 2023 (%)

- Molnlycke Health: Net Sales, 2023-2033 ($ Billion)

- Molnlycke Health: Revenue Share, By Segment, 2023 (%)

- Molnlycke Health: Revenue Share, By Region, 2023 (%)

- Moldex-Metric: Net Sales, 2023-2033 ($ Billion)

- Moldex-Metric: Revenue Share, By Segment, 2023 (%)

- Moldex-Metric: Revenue Share, By Region, 2023 (%)

- Ansell: Net Sales, 2023-2033 ($ Billion)

- Ansell: Revenue Share, By Segment, 2023 (%)

- Ansell: Revenue Share, By Region, 2023 (%)

- Unicharm: Net Sales, 2023-2033 ($ Billion)

- Unicharm: Revenue Share, By Segment, 2023 (%)

- Unicharm: Revenue Share, By Region, 2023 (%)

- Cardinal Health: Net Sales, 2023-2033 ($ Billion)

- Cardinal Health: Revenue Share, By Segment, 2023 (%)

- Cardinal Health: Revenue Share, By Region, 2023 (%)

- Te Yin: Net Sales, 2023-2033 ($ Billion)

- Te Yin: Revenue Share, By Segment, 2023 (%)

- Te Yin: Revenue Share, By Region, 2023 (%)

- Japan Vilene: Net Sales, 2023-2033 ($ Billion)

- Japan Vilene: Revenue Share, By Segment, 2023 (%)

- Japan Vilene: Revenue Share, By Region, 2023 (%)

- Shanghai Dasheng: Net Sales, 2023-2033 ($ Billion)

- Shanghai Dasheng: Revenue Share, By Segment, 2023 (%)

- Shanghai Dasheng: Revenue Share, By Region, 2023 (%)

- Hakugen: Net Sales, 2023-2033 ($ Billion)

- Hakugen: Revenue Share, By Segment, 2023 (%)

- Hakugen: Revenue Share, By Region, 2023 (%)

- Essity (BSN Medical): Net Sales, 2023-2033 ($ Billion)

- Essity (BSN Medical): Revenue Share, By Segment, 2023 (%)

- Essity (BSN Medical): Revenue Share, By Region, 2023 (%)

- Zhende: Net Sales, 2023-2033 ($ Billion)

- Zhende: Revenue Share, By Segment, 2023 (%)

- Zhende: Revenue Share, By Region, 2023 (%)

- Winner: Net Sales, 2023-2033 ($ Billion)

- Winner: Revenue Share, By Segment, 2023 (%)

- Winner: Revenue Share, By Region, 2023 (%)

- Jiangyin Chang-hung: Net Sales, 2023-2033 ($ Billion)

- Jiangyin Chang-hung: Revenue Share, By Segment, 2023 (%)

- Jiangyin Chang-hung: Revenue Share, By Region, 2023 (%)

- Tamagawa Eizai: Net Sales, 2023-2033 ($ Billion)

- Tamagawa Eizai: Revenue Share, By Segment, 2023 (%)

- Tamagawa Eizai: Revenue Share, By Region, 2023 (%)

- Gerson: Net Sales, 2023-2033 ($ Billion)

- Gerson: Revenue Share, By Segment, 2023 (%)

- Gerson: Revenue Share, By Region, 2023 (%)

- Suzhou Sanical: Net Sales, 2023-2033 ($ Billion)

- Suzhou Sanical: Revenue Share, By Segment, 2023 (%)

- Suzhou Sanical: Revenue Share, By Region, 2023 (%)

- Sinotextiles: Net Sales, 2023-2033 ($ Billion)

- Sinotextiles: Revenue Share, By Segment, 2023 (%)

- Sinotextiles: Revenue Share, By Region, 2023 (%)

- Alpha Pro Tech: Net Sales, 2023-2033 ($ Billion)

- Alpha Pro Tech: Revenue Share, By Segment, 2023 (%)

- Alpha Pro Tech: Revenue Share, By Region, 2023 (%)

- Irema: Net Sales, 2023-2033 ($ Billion)

- Irema: Revenue Share, By Segment, 2023 (%)

- Irema: Revenue Share, By Region, 2023 (%)

- Yuanqin: Net Sales, 2023-2033 ($ Billion)

- Yuanqin: Revenue Share, By Segment, 2023 (%)

- Yuanqin: Revenue Share, By Region, 2023 (%)

- Troge Medical: Net Sales, 2023-2033 ($ Billion)

- Troge Medical: Revenue Share, By Segment, 2023 (%)

- Troge Medical: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Dental Bonding Agents and Adhesives Industry

Conducting a competitor analysis involves identifying competitors within the Dental Bonding Agents and Adhesives industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Dental Bonding Agents and Adhesives market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Dental Bonding Agents and Adhesives market research process:

Key Dimensions of Dental Bonding Agents and Adhesives Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Dental Bonding Agents and Adhesives market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Dental Bonding Agents and Adhesives industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Dental Bonding Agents and Adhesives Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Dental Bonding Agents and Adhesives Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Dental Bonding Agents and Adhesives market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Dental Bonding Agents and Adhesives market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Dental Bonding Agents and Adhesives market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Dental Bonding Agents and Adhesives industry.